When facing the prospect of dental implants, one of the most pressing questions patients ask is: “Will health insurance cover dental implants?” The answer isn’t straightforward, as coverage depends on multiple factors including your specific insurance plan, the medical necessity of the procedure, and the circumstances surrounding your tooth loss. This comprehensive guide will walk you through everything you need to know about dental implant insurance coverage, helping you navigate this complex landscape with confidence.

Understanding Dental Implant Coverage: The Current Landscape

The relationship between health insurance and dental implant coverage has evolved significantly over the past few years. Traditionally, most insurance plans classified dental implants as cosmetic procedures, offering little to no coverage. However, the landscape is changing as many newer or enhanced plans now offer partial coverage for implants under their major services category.

What Are Dental Implants?

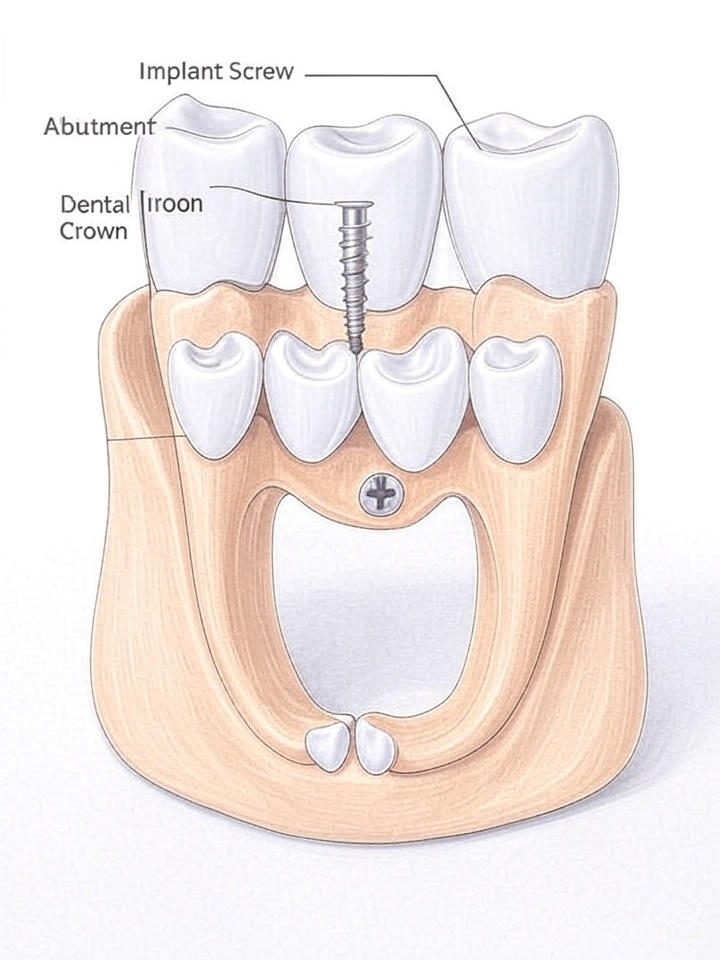

Before diving into insurance coverage, it’s essential to understand what dental implants are and why they might be considered medically necessary. According to Wikipedia, a dental implant is a surgical component that interfaces with the bone of the jaw or skull to support a dental prosthesis such as a crown, bridge, denture, or facial prosthesis.

Dental implants serve as artificial tooth roots, providing a permanent solution for missing teeth. Unlike dentures or bridges, implants integrate with your jawbone through a process called osseointegration, creating a stable foundation for replacement teeth.

The Key Factor: Medical Necessity vs. Cosmetic Treatment

The most crucial factor determining insurance coverage for dental implants is whether the procedure is deemed medically necessary or purely cosmetic. If your dental implant is medically necessary, your dental insurance plan may cover some of the costs.

When Are Dental Implants Considered Medically Necessary?

Insurance companies have specific criteria for determining medical necessity. Every insurance company has its own definition of what it means for something to be medically necessary. Some common criteria may stipulate that the service is: Clinically appropriate. Not primarily for a patient’s convenience. Not more expensive than procedures that deliver the same level of care.

Common scenarios where dental implants may be considered medically necessary include:

Traumatic Injury: When tooth loss results from an accident, trauma, or injury, insurance companies are more likely to view implants as medically necessary rather than cosmetic.

Disease-Related Tooth Loss: Insurance companies often require a clear medical necessity for the procedure, which can include conditions such as tooth loss due to an accident, certain diseases, or congenital absence of teeth.

Congenital Conditions: Some individuals are born without certain teeth (congenital absence), making implants a medical necessity rather than a cosmetic choice.

Functional Impairment: When missing teeth significantly impact your ability to eat, speak, or maintain proper oral health, implants may be considered medically necessary.

Cancer Treatment: Patients who lose teeth due to cancer treatment or radiation therapy often qualify for coverage as the tooth loss is considered a medical consequence of necessary treatment.

Types of Insurance That May Cover Dental Implants

Understanding the different types of insurance and their coverage policies is crucial for patients seeking implant treatment.

Dental Insurance Coverage

Most traditional dental insurance plans categorize treatments into three groups: preventive, basic, and major services. Dental implants typically fall under major services, which usually have the lowest coverage percentage and highest out-of-pocket costs.

Always check the annual maximum benefit—many plans only pay up to $1,500/year, which may not even cover one implant. This limitation means that even with coverage, patients often face significant out-of-pocket expenses.

Some dental insurance plans offer graduated coverage for implants. For example, It covers 10% of implants on day one with no waiting periods and then increases to 40% after one year and 50% after two years. This structure encourages long-term membership while providing increasing benefits over time.

Medical Insurance Coverage

While dental insurance focuses on oral health, medical insurance may cover dental implants when they’re deemed medically necessary. This typically occurs when:

- The tooth loss is due to a medical condition

- The implant is necessary to treat or prevent a medical problem

- The procedure is integral to other covered medical treatments

Medicare and Dental Implants

Traditional Medicare (Parts A and B) typically doesn’t cover dental implants, as they’re considered dental procedures rather than medical ones. However, One Medicare Advantage plan, Medicare Part C, provides options for dental services. If dental implant coverage is important to you, this plan is likely your best option.

Medicare is health insurance that provides benefits for patients over the age of 65 who have a “medical necessity.” If you have a condition that, if left untreated, would worsen and impact your well-being, then this condition may be covered, in part, by Medicare insurance.

How to Maximize Your Insurance Coverage for Dental Implants

Getting insurance coverage for dental implants requires strategic planning and proper documentation. Here’s how to improve your chances of coverage:

1. Obtain Proper Documentation

Proof of medical necessity requires a letter from a dentist, oral surgeon, or doctor that explains why implants are necessary for your health – and not an elective, cosmetic procedure.

Essential documentation includes:

- Detailed medical and dental history

- X-rays and diagnostic imaging

- Treatment records showing the cause of tooth loss

- Letters from healthcare providers explaining medical necessity

- Documentation of alternative treatments considered

2. Work with Your Healthcare Team

Insurance requires proof of medical necessity. You need documentation like X-rays, medical history, and a referral from a dentist or doctor. Collaborating with your dental team to build a strong case for medical necessity is crucial.

3. Understand Your Plan’s Specifics

Before proceeding with treatment, thoroughly review your insurance policy. Look for:

- Annual maximum benefits

- Waiting periods for major procedures

- Pre-authorization requirements

- Network provider restrictions

- Exclusions and limitations

4. Consider Pre-Authorization

Many insurance plans require pre-authorization for major dental procedures. Submitting a detailed treatment plan with supporting documentation before treatment can help avoid surprises and denials.

Alternative Financing Options

When insurance coverage is limited or unavailable, several alternative financing options can help make dental implants more affordable:

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

You can also use a health savings account (HSA) or flexible spending account (FSA) to pay for medically necessary dental implants. HSAs and FSAs let you save money in an account before it’s taxed, providing significant savings on qualifying medical expenses.

Dental Financing Plans

Many dental practices offer financing options through third-party companies, allowing patients to spread costs over time with competitive interest rates.

Dental Schools and Clinical Programs

Dental schools and residency programs often provide implant services at reduced costs, though treatment may take longer due to the educational nature of the programs.

The Rising Costs and Economic Impact

The cost of dental implants continues to rise, making insurance coverage increasingly important. According to Forbes, dental implant costs can range from $3,000 to $6,000 per tooth, making it one of the most expensive dental procedures.

This economic reality has led to increased awareness of oral health’s connection to overall health. Studies published in reputable medical journals have demonstrated links between oral health and systemic conditions like heart disease, diabetes, and respiratory infections, supporting the argument for treating dental implants as medical necessities rather than cosmetic procedures.

Common Insurance Exclusions and Limitations

Understanding what your insurance won’t cover is as important as knowing what it will cover. Common exclusions include:

Cosmetic Procedures

If the primary purpose of the implant is cosmetic improvement rather than functional restoration or medical necessity, most insurance plans will deny coverage.

Pre-Existing Conditions

Some plans exclude coverage for conditions that existed before your policy became effective.

Experimental or Investigational Procedures

New implant technologies or techniques may be excluded until they become standard care.

Self-Inflicted Injuries

Tooth loss due to neglect, substance abuse, or intentional self-harm is typically excluded from coverage.

The Future of Dental Implant Insurance Coverage

The dental insurance industry is evolving, with increasing recognition of the medical necessity of certain dental procedures. As research continues to demonstrate the connection between oral health and overall health, we can expect to see:

- Expanded coverage for medically necessary dental procedures

- Integration of dental and medical insurance plans

- Increased focus on preventive care to avoid the need for major procedures

- Technology advances making implants more accessible and affordable

Building Your Case: Documentation and Evidence

Success in getting insurance coverage often depends on the strength of your documentation. Work with your dental team to compile:

Medical Records

Comprehensive medical records showing the underlying cause of tooth loss and any related health conditions.

Diagnostic Imaging

X-rays, CT scans, and other imaging studies that demonstrate the extent of bone loss and the need for implants.

Treatment Alternatives

Documentation showing that less expensive alternatives (like partial dentures) are not suitable due to medical factors.

Professional Opinions

Letters from multiple healthcare providers supporting the medical necessity of implants.

Managing Health Anxiety During the Process

Navigating insurance coverage for dental implants can be stressful and may trigger health anxiety in some patients. The uncertainty of coverage, combined with concerns about oral health, can create significant emotional distress. For those struggling with health-related anxiety during this process, our comprehensive guide on health anxiety management provides valuable strategies for coping with medical-related stress and maintaining mental well-being throughout your treatment journey.

The Role of Faith and Support Systems

For many patients, facing major dental procedures and insurance challenges can be emotionally overwhelming. Having a strong support system and maintaining faith can provide comfort during difficult times. If you’re someone who finds strength in faith and would like daily spiritual encouragement, consider exploring our Bible verse generator tool for daily inspiration and guidance through challenging times.

State-by-State Variations in Coverage

Insurance regulations vary significantly by state, affecting coverage availability and requirements. Some states have mandated coverage for certain dental procedures, while others leave it entirely to individual insurance companies to determine coverage policies.

Research your state’s insurance regulations and consider consulting with a local insurance expert who understands the specific requirements and opportunities in your area.

Tips for Working with Insurance Companies

Successfully navigating insurance coverage requires patience and persistence. Here are key strategies:

1. Document Everything

Keep detailed records of all communications with your insurance company, including dates, times, representative names, and conversation summaries.

2. Appeal Denials

Don’t accept the first denial. Many insurance companies have multiple levels of appeal, and persistence often pays off.

3. Understand the Timeline

Be aware of deadlines for submitting claims, appeals, and required documentation.

4. Seek Professional Help

Consider working with a dental insurance specialist or patient advocate who can help navigate complex insurance policies.

The Broader Healthcare Context

Dental implant coverage is part of a larger conversation about the integration of oral health and overall health care. Organizations like the American Dental Association and the World Health Organization continue to advocate for recognition of oral health as an integral part of general health.

This advocacy is gradually influencing insurance policies, with more companies recognizing that preventive dental care and necessary dental procedures can prevent more expensive medical complications down the line.

Emerging Trends in Dental Insurance

Several trends are shaping the future of dental implant coverage:

Value-Based Care

Insurance companies are increasingly focusing on outcomes rather than just procedures, which may favor comprehensive treatments like implants that provide long-term solutions.

Teledentistry Integration

Remote consultations and digital treatment planning are making dental care more accessible and may influence coverage decisions.

Preventive Focus

Greater emphasis on preventive care aims to reduce the need for major procedures like implants, but when they are necessary, coverage may be more comprehensive.

Making Informed Decisions

When considering dental implants, it’s essential to:

- Thoroughly research your insurance coverage before beginning treatment

- Get multiple opinions from qualified dental professionals

- Consider all treatment alternatives and their long-term implications

- Plan financially for potential out-of-pocket expenses

- Understand the timeline for treatment and insurance processing

Conclusion: Navigating Your Path to Coverage

The question “Will health insurance cover dental implants?” doesn’t have a simple yes or no answer. Coverage depends on multiple factors including the medical necessity of your specific situation, your insurance plan’s terms, and your ability to document and advocate for your case.

While the landscape of dental implant insurance coverage continues to evolve, patients today have more options and opportunities for coverage than ever before. The key is understanding your specific situation, working closely with your healthcare team, and being persistent in advocating for appropriate coverage.

Remember that dental implants are often a long-term investment in your oral health and overall quality of life. Even if insurance coverage is limited, the functional and health benefits of implants may justify the investment when compared to the ongoing costs and limitations of alternative treatments.

As healthcare continues to evolve toward a more integrated approach that recognizes the connection between oral health and overall health, we can expect to see continued improvements in insurance coverage for medically necessary dental procedures, including implants.

The most important step you can take is to be proactive in understanding your coverage, documenting your case, and working with qualified professionals who can help you navigate this complex but manageable process. With proper planning and persistence, many patients successfully obtain at least partial insurance coverage for their dental implant needs.

Whether you’re just beginning to explore dental implants or are already in the process of seeking coverage, remember that you’re not alone in this journey. Healthcare advocates, dental professionals, and insurance specialists are available to help you understand your options and maximize your benefits.

Take the time to thoroughly research your options, ask questions, and advocate for yourself throughout the process. Your oral health is an investment in your overall well-being, and with the right approach, you can find a path forward that works for your medical needs and financial situation.

Pingback: Why Health Promotion is Important: A Comprehensive Guide to Building Healthier Communities in 2025 - Snapspeak